Get To Know The Top 10 Gyms In Virar?

We have all heard that fitness isn’t just a choice, but it is a lifestyle! And to follow that lifestyle, …

Know The Top 10 Gyms In Nalasopara?

There are a number of Gyms in Nalasopara, right? And if you have been searching for one, you sure know …

Do you wish to enjoy some baked goodies with delicious tea or coffee? Looking for an aesthetic place to enjoy …

Foodies alert! We have this super amazing list of Top 10 Restaurants In Virar for you that will make you …

The Vasai Kala Krida Mahotsav has been celebrated for many years in Vasai. It all started in the year 1989. In 2014 the Silver Jubilee was celebrated with great enthusiasm and in the following year the event witnessed a humongous …

Vasai Fort; Popular Spot For Music Video And Film Shoot

Vasai Fort is one of the popular spots for Bollywood movie shooting in Mumbai. There have been several movie scenes, and songs shot here at Vasai Fort. And these movies and songs are of some of the best actors and …

Vasai Passport Office | Passport Seva Kendra in Vasai-Virar

Good news for the citizens of Vasai-Virar, Passport Office Vasai is going to start soon in Evershine City of Vasai East, Palghar District. Post Office Passport Seva Kendra Vasai inaugurate on 06 December 2022 by Shri. Rajendra Gavit is a …

Google Ads

Best Product Photography & Product Videography Services In Vasai Virar

Ad space Digital Vasai Vasai West Opens Mon – Sat 3 Years in Business Call us Chat Visit site Share …

Mrs. India Inc 2023 Finalist; Shweta Pote | Talented Vasai Virar Creator In The Modelling Industry

Vasai Virar is undeniably a cradle of extraordinary talents like Shweta Pote, a place where dreams take root and soar …

Vasai Virar Creator Anish Pereira Making It Huge In Dublin, Ireland; Rising Travel Vlogger

This Vasai Virar Creator is flying high for real! Anish Pereira a Travel Vlogger is among the known Vasai Virar …

Best Product Photography & Product Videography Services In Vasai Virar

Ad space Digital Vasai Vasai West Opens Mon – Sat 3 Years in Business Call us Chat Visit site Share …

Mrs. India Inc 2023 Finalist; Shweta Pote | Talented Vasai Virar Creator In The Modelling Industry

Vasai Virar is undeniably a cradle of extraordinary talents like Shweta Pote, a place where dreams take root and soar …

Vasai Virar Creator Anish Pereira Making It Huge In Dublin, Ireland; Rising Travel Vlogger

This Vasai Virar Creator is flying high for real! Anish Pereira a Travel Vlogger is among the known Vasai Virar …

Google Ads

Kantara 2 Release Date; Kantara Prequel Confirms Rishab Shetty

One of the biggest blockbusters of Indian Cinema, the Kannada film ‘Kantara’ is all set to have a prequel very …

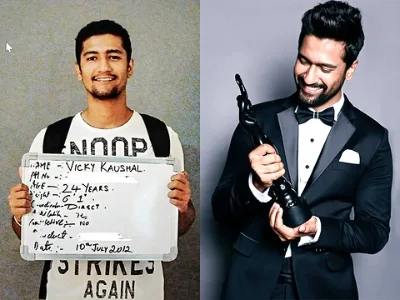

Vicky Kaushal is known for his amazing performances in many Bollywood movies and in Famous Series. Vicky Kaushal has played …

Bollywood Actor Ranveer Singh | Ranveer Singh Bollywood Journey

Does Ranveer Singh’s power pack appearance always fascinate you? Are you curious to know all about Ranveer Singh and about …

If Sidharth Malhotra is in your heart, then you will become an even bigger fan of this star boy after …

Know Which Are The Top 10 Trending Indian Web Series Till 2023; Must-Watch Indian Web Series

Do you want to know which are the top 10 trending Indian web series till 2023? These are the most …

Vasai is quite famous for its food and especially the amazing Seafood Restaurants in Vasai. There are a number of …

Get Smart: The Best Smartwatch Under 2000 INR

Are you in the market for a new smartwatch but want to stay within a budget? Look no further! This …

10 Best Refrigerators In India: A Comprehensive Guide

Did you know that selecting a refrigerator involves more factors than just size and colour? A dependable freezer is necessary …

Hey, are you looking for common Digital Marketing Interview Questions? Even if you are not looking for a digital marketing …

How To Behave During The Interview? | Interview Behavior Tips

Are you about to get into the industry you wish for? Is it your first time appearing for the job? …

Basic Interview Preparation Tips

Are you ready to rock your next job interview in your field? Getting a job isn’t easy. You need to …

To know how to behave in the interview, read our blog on How To Behave During The Interview?

Hey, are you looking for common Digital Marketing Interview Questions? Even if you are not looking for a digital marketing …

International Schools In Vasai, Virar, & Nallasopara | International Schools Near Me | Best International Schools

One of the most important decisions is to select the right school. Because it moulds the child and is the

English Medium Schools In Vasai | Best English Medium Schools in Vasai | Schools Near Me

Are you looking for English Medium Schools In Vasai? Education is the core factor contributing to the developing years of

Special Schools In Vasai, Virar, & Nalasopara | Special Education Schools | Special Schools Near Me

Are you looking for the best Special Schools in Vasai, Virar, and Nalasopara? We have a few schools listed below

English Medium Schools in Virar | Best English Medium School In Virar | Schools Near Me

Looking for the best English Medium School in Virar? Look no further! Here you will find top-rated English Medium Schools

Google Ads

Hey, are you looking for common Digital Marketing Interview Questions? Even if you are not looking for a digital marketing

How To Behave During The Interview? | Interview Behavior Tips

Are you about to get into the industry you wish for? Is it your first time appearing for the job?

Basic Interview Preparation Tips

Are you ready to rock your next job interview in your field? Getting a job isn’t easy. You need to

International Schools In Vasai, Virar, & Nallasopara | International Schools Near Me | Best International Schools

One of the most important decisions is to select the right school. Because it moulds the child and is the

English Medium Schools In Vasai | Best English Medium Schools in Vasai | Schools Near Me

Are you looking for English Medium Schools In Vasai? Education is the core factor contributing to the developing years of

Special Schools In Vasai, Virar, & Nalasopara | Special Education Schools | Special Schools Near Me

Are you looking for the best Special Schools in Vasai, Virar, and Nalasopara? We have a few schools listed below

English Medium Schools in Virar | Best English Medium School In Virar | Schools Near Me

Looking for the best English Medium School in Virar? Look no further! Here you will find top-rated English Medium Schools

English Medium Schools In Nallasopara | Best English Medium School | Schools Near Me

Are you looking for Marathi Medium School in Vasai, Virar and Nallasopara? Selecting the right school is very crucial for

Hindi Medium School in Vasai, Nallasopara, and Virar | Schools Near Me | Best Hindi Medium Schools

Are you looking for Hindi Medium School near me? Here you’ll find almost every Hindi Medium School in Vasai, Nallasopara,

Are you looking for Marathi Medium School in Vasai, Virar and Nallasopara? Here you’ll find almost every Marathi Medium School

Career Opportunities After 12th Commerce: Options Galore

Welcome to our latest blog post, where we’ll be exploring the diverse and exciting world of the best career options

To know how to behave in the interview, read our blog on How To Behave During The Interview?

Hey, are you looking for common Digital Marketing Interview Questions? Even if you are not looking for a digital marketing

What Are Common Sales Interview Questions 2024?

Are you about to start a career in the Sales industry? Want to know the common Sales Interview Questions? Then

Google Ads

Get Smart: The Best Smartwatch Under 2000 INR

Are you in the market for a new smartwatch but want to stay within a budget? Look no further! This …

10 Best Refrigerators In India: A Comprehensive Guide

Did you know that selecting a refrigerator involves more factors than just size and colour? A dependable freezer is necessary …

India’s Best Gym Equipment Brands: A Guide

Whether outfitting your own home gym or planning to open a full commercial training facility, selecting the right gym equipment …

Best Trading Apps In India: Top 5 Picks

Time is crucial when it comes to investing and looking for Best Trading Apps in India. Traders must stay current …

Get To Know The Top 10 Gyms In Virar?

We have all heard that fitness isn’t just a choice, but it is a lifestyle! And to follow that lifestyle,

Know The Top 10 Gyms In Nalasopara?

There are a number of Gyms in Nalasopara, right? And if you have been searching for one, you sure know

Do you wish to enjoy some baked goodies with delicious tea or coffee? Looking for an aesthetic place to enjoy

Foodies alert! We have this super amazing list of Top 10 Restaurants In Virar for you that will make you

Google Ads

Best Tips For Glowing Skin In Summers: Effective & Natural Home Remedies

Health Tips: Summer is here and one concern that bothers everyone during summers is their skin health. But, don’t stress …

Vasai is quite famous for its food and especially the amazing Seafood Restaurants in Vasai. There are a number of

Know The Best Homemade Snacks Suppliers In Virar & Nalasopara

Are you a fan of homemade snacks? Would you choose to snack on some homemade snacks over street food snacks?

Famous Food Stalls In Vasai: Best Street Food Places

There must have been so many times when you have craved some delicious street-side food. Right? And who wouldn’t want

Want To Know The Most Tasty & Healthy Homemade Snacks Supplier In Vasai?

We all love snacks, don’t we? But when it comes to homemade snacks, there’s no comparison in terms of taste

Google Ads

Web Stories

Trending Posts

Vasai Virar News is a news media website and your one-stop destination for something more than just headlines—the latest stories happening in your surroundings that matter to you.

We offer 24/7 Live Top India News and cover a wide range of topics like News, Tech, Jobs, Business, Education, Entertainment, Food, Fitness, Top 10, Popular, and Video. Besides that, we cover local topics like famous people, cafe, beach,fort, and movie.

From local to global news coverage, we have your back. Moreover, we always offer interesting, insightful, and authentic news on your favorite topics. Vasai Virar News knows not everyone loves to read. Thus, we bring multimedia content such as infographics, videos, and photos to improve the user experience.

Vasai Virar News Today Live is more than just a news outlet because we offer authentic information about the lives and industries that shape our world.

Multimedia Content: Multimedia content, such as photos, videos, and infographics, enhances the user experience onVasai Virar News websites by adding visual appeal and adding depth in storytelling.